NPS VATSALYA: ਐੱਨਪੀਐੱਸ ਵਾਤਸਲਯ ਯੋਜਨਾ ਦੀ ਹੋਈ ਸ਼ੁਰੂਆਤ, ਵਿੱਤ ਮੰਤਰੀ ਵੱਲੋਂ ਆਨਲਾਈਨ ਪੋਰਟਲ ਜਾਰੀ

ਨਵੀਂ ਦਿੱਲੀ, 18 ਸਤੰਬਰ 2024 ( ਜਾਬਸ ਆਫ ਟੁਡੇ)ਐੱਨਪੀਐੱਸ ਵਾਤਸਲਯ ਦੇ ਨਾਮ ਹੇਠ ਕੰਟਰੀਬਿਊਟਰੀ ਪੈਨਸ਼ਨ ਸਕੀਮ ਜੋ ਪੀਐੱਫਆਰਡੀਏ ਵੱਲੋਂ ਨਿਯੰਤ੍ਰਿਤ ਅਤੇ ਸੰਚਾਲਿਤ ਕੀਤੀ ਜਾਂਦੀ ਹੈ, ਨੂੰ ਅੱਜ ਵਿੱਤ ਮੰਤਰੀ, ਭਾਰਤ ਸਰਕਾਰ, ਸ਼੍ਰੀਮਤੀ ਨਿਰਮਲਾ ਸੀਤਾਰਮਨ ਵੱਲੋਂ ਲਾਂਚ ਕੀਤਾ ਗਿਆ। ਲਾਂਚਿੰਗ ਦਾ ਸਿੱਧਾ ਪ੍ਰਸਾਰਣ ਅੱਜ ਲੀਡ ਬੈਂਕ ਦਫ਼ਤਰ, ਪਟਿਆਲਾ ਵੱਲੋਂ ਸਰਕਾਰੀ ਮੈਰੀਟੋਰੀਅਸ ਸਕੂਲ, ਪਟਿਆਲਾ ਵਿਖੇ ਕੀਤਾ ਗਿਆ। ਇਸ ਮੌਕੇ ਸਟੇਟ ਬੈਂਕ ਆਫ ਇੰਡੀਆ ਦੇ ਖੇਤਰੀ ਮੈਨੇਜਰ ਪ੍ਰਵੀਨ ਪ੍ਰਸਾਦ ਸਮੇਤ ਸਟੇਟ ਲੈਵਲ ਬੈਂਕਰਜ਼ ਕਮੇਟੀ (ਐੱਸ.ਐੱਲ.ਬੀ.ਸੀ.), ਪੰਜਾਬ ਦੇ ਅਧਿਕਾਰੀ ਹਾਜ਼ਰ ਸਨ।

ਇਸ ਮੌਕੇ 'ਤੇ ਸ਼੍ਰੀ ਪਰਵੀਨ ਪ੍ਰਸਾਦ ਨੇ ਦੱਸਿਆ ਕਿ ਇਹ ਯੋਜਨਾ ਪੈਨਸ਼ਨ ਪ੍ਰਾਪਤ ਸਮਾਜ ਦੀ ਸਿਰਜਣਾ ਦੇ ਅੰਤਮ ਉਦੇਸ਼ ਨਾਲ ਬੱਚਿਆਂ ਦੇ ਸਸ਼ਕਤੀਕਰਨ ਨੂੰ ਉਤਸ਼ਾਹਿਤ ਕਰਨ ਲਈ ਸ਼ੁਰੂ ਕੀਤੀ ਗਈ ਹੈ। ਉਨ੍ਹਾਂ ਅੱਗੇ ਦੱਸਿਆ ਕਿ 18 ਸਾਲ ਤੱਕ ਦੇ ਸਾਰੇ ਨਾਬਾਲਗ ਨਾਗਰਿਕ ਇਸ ਸਕੀਮ ਵਿੱਚ ਸ਼ਾਮਲ ਹੋ ਸਕਦੇ ਹਨ। ਖ਼ਾਤਾ ਖੋਲ੍ਹਣ ਲਈ ਘੱਟੋ-ਘੱਟ ਯੋਗਦਾਨ ਰੁਪਏ 1,000/- ਹੈ। ਨਾਬਾਲਗ ਇਸ ਸਕੀਮ ਦੇ ਇਕੱਲੇ ਲਾਭਪਾਤਰੀ ਹੋਣਗੇ ਅਤੇ ਮਾਪੇ/ਸਰਪ੍ਰਸਤ ਨਾਬਾਲਗਾਂ ਦੇ ਨਾਮ 'ਤੇ ਖ਼ਾਤਾ ਖੋਲ੍ਹ ਸਕਦੇ ਹਨ ਅਤੇ ਯੋਗਦਾਨ ਪਾ ਸਕਦੇ ਹਨ। ਉਨ੍ਹਾਂ ਕਿਹਾ ਕਿ ਨਾਬਾਲਗ ਖਾਤਾਧਾਰਕ ਵੱਲੋਂ 18 ਸਾਲ ਦੀ ਉਮਰ ਪੂਰੀ ਹੋਣ 'ਤੇ ਨਿਯਮਤ ਐੱਨਪੀਐੱਸ ਖ਼ਾਤੇ ਵਿੱਚ ਨਿਰਵਿਘਨ ਰੂਪਾਂਤਰਨ ਕੀਤਾ ਜਾਵੇਗਾ। ਉਨ੍ਹਾਂ ਇਹ ਵੀ ਦੱਸਿਆ ਕਿ ਖ਼ਾਤਾ ਧਾਰਕ ਵੱਲੋਂ ਵੱਧ ਤੋਂ ਵੱਧ ਯੋਗਦਾਨ ਦੀ ਕੋਈ ਹੱਦ ਨਹੀਂ ਹੋਵੇਗੀ।

ਲੀਡ ਬੈਂਕ ਮੈਨੇਜਰ ਰਾਜੀਵ ਸਰਹਿੰਦੀ ਨੇ ਦੱਸਿਆ ਕਿ ਇਸ ਮੌਕੇ ਬੱਚਿਆਂ ਲਈ ਆਨਲਾਈਨ ਕਠਪੁਤਲੀ ਅਤੇ ਮੈਜਿਕ ਸ਼ੋਅ ਦੇ ਨਾਲ-ਨਾਲ ਕੁਇਜ਼ ਦਾ ਵੀ ਪ੍ਰਬੰਧ ਕੀਤਾ ਗਿਆ ਸੀ। ਉਨ੍ਹਾਂ ਦੱਸਿਆ ਕਿ ਸਰਕਾਰੀ ਮੈਰੀਟੋਰੀਅਸ ਸਕੂਲ, ਪਟਿਆਲਾ ਦੇ ਸਹਿਯੋਗ ਨਾਲ ਪ੍ਰਿੰਸੀਪਲ ਸ਼੍ਰੀਮਤੀ ਦੀਪ ਮਾਲਾ ਅਤੇ ਵਾਈਸ ਪ੍ਰਿੰਸੀਪਲ ਗਗਨ ਬਾਂਸਲ ਦੀ ਯੋਗ ਅਗਵਾਈ ਵਿੱਚ ਨੁੱਕੜ ਨਾਟਕ ਦਾ ਵੀ ਆਯੋਜਨ ਕੀਤਾ ਗਿਆ, ਜਿਸ ਵਿੱਚ ਲੀਡ ਬੈਂਕ ਆਫਿਸ ਵੱਲੋਂ ਬੱਚਿਆਂ ਨੂੰ ਉਨ੍ਹਾਂ ਦੇ ਪ੍ਰਦਰਸ਼ਨ ਲਈ ਸਨਮਾਨਿਤ ਕੀਤਾ ਗਿਆ। ਇਸ ਮੌਕੇ ਡੀਡੀਐੱਮ ਨਬਾਰਡ ਪਰਵਿੰਦਰ ਕੌਰ ਨਾਗਰਾ ਨੇ ਹਾਜ਼ਰ ਬੱਚਿਆਂ ਨੂੰ ਮਿਠਾਈਆਂ ਅਤੇ ਤੋਹਫ਼ੇ ਵੰਡੇ।

NPS Vatsalya: Flexibility and Benefits for Minors

The National Pension System (NPS) Vatsalya is a pension scheme tailored for minors, offering flexibility and long-term financial security. Regulated by the Pension Fund Regulatory and Development Authority (PFRDA), it aims to ensure financial stability for young citizens as they grow older. Here's a breakdown of how the scheme works:

Key Features Before Turning 18

1. Partial Withdrawals

- Available after three years of joining the NPS.

- Minors can withdraw up to 25% of the contributed amount for specific purposes, including education, treatment of specified illnesses, or disabilities over 75%.

- Withdrawals are allowed up to three times before turning 18.

2. NPS Account Operation

- The account is opened in the minor’s name but operated by the guardian until the minor turns 18.

- A minimum contribution of Rs. 1,000 per year is required, with no upper limit.

3. Investment Choices

- Guardians can choose from three fund options: Default (LC-50), Auto (LC-75 or LC-25), or Active, depending on their risk preference.

Benefits After Turning 18

1. Automatic Conversion

- Once the subscriber turns 18, the NPS Vatsalya account is automatically converted into a regular All Citizen NPS account.

- Subscribers are required to complete a fresh KYC within three months of turning 18.

2. Continued Flexibility

- Subscribers have the option to continue or exit the NPS.

- For withdrawals, 80% of the corpus must be reinvested in an annuity plan, while the remaining 20% can be taken as a lump sum.

3. Withdrawal Options

- If the accumulated corpus exceeds Rs. 2.5 lakh, the account holder must use 80% for annuity purchases, with the rest available as a lump sum.

- For corpus amounts below Rs. 2.5 lakh, the entire sum can be withdrawn as a lump sum.

Conclusion

NPS Vatsalya provides a robust financial foundation for minors, ensuring that they have access to funds when necessary and a secure pension upon reaching adulthood. It’s a valuable tool for parents and guardians to plan for their children's future, combining flexibility with long-term savings potential.

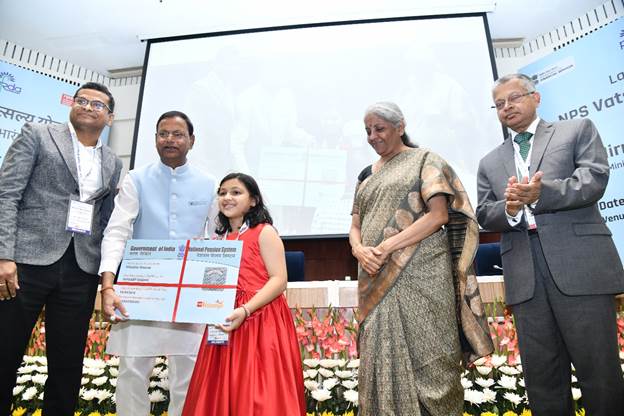

Union Finance Minister Smt. Nirmala Sitharaman launches NPS Vatsalya in New Delhi today

NPS Vatsalya is an important constituent towards fulfilling vision of the Prime Minster, Shri Narendra Modi, in creating Viksit Bharat@2047: Smt. Sitharaman

NPS Vatsalya scheme is a significant step by the Government towards inclusive economic development: MoS Finance Shri Pankaj Chaudhary

Recent reforms have expanded scope of pension coverage, aiming to create a more inclusive system through more products: DFS Secretary

NPS Vatsalya is Government’s forward-thinking approach, under the overarching objective of provision of social security for all: PFRDA Chairman

Union Finance Minister also launched an online platform for subscribing to NPS Vatsalya and released the scheme brochure

Smt. Sitharaman and Shri Chaudhary also distributed PRAN cards to minor subscribers from different parts of the country

Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman launched the National Pension System Vatsalya (NPS Vatsalya) scheme, ‘a pension scheme for minors’ at New Delhi, today. The NPS Vatsalya was announced by the Union Finance Minister in the Union Budget 2024-25 on 23rd July, 2024.

Union Minister of State for Finance Shri Pankaj Chaudhary; Shri Nagaraju Maddirala, Secretary, Department of Financial Services (DFS); and Shri Deepak Mohanty, Chairman Pension Fund Regulatory Authority of India (PFRDA) were also present besides senior officials from DFS and PFRDA along with school children, their parents and other esteemed guests.

The launch of NPS Vatsalya was simultaneously organised at 75 locations throughout the country, with distribution of over 250 PRAN to minor subscribers. At all the locations, school-going children enthusiastically attended the event.

During the event, Union Finance Minister also launched an online platform for subscribing to NPS Vatsalya, released the scheme brochure.

Smt. Sitharaman also released a brochure, detailing the features of the NPS Vatsalya scheme.

Smt. Sitharaman and Shri Chaudhary also distributed permanent retirement account number (PRAN) cards to minor subscribers who had come from different parts of the country.

In her keynote address at the launch, Union Finance Minister Smt. Nirmala Sitharaman said that the scheme will be an important constituent towards fulfilling vision of the Prime Minister, Shri Narendra Modi, in creating Viksit Bharat@2047.

Smt. Sitharaman said that NPS Vatsalya is a significant step in Government’s endeavour to promote long-term financial planning and security for all the citizens. Besides securing the future of subscribers, NPS Vatsalya is based on the principle of intergenerational equity by providing cover to older and young members of the family.

It is envisaged that NPS Vatsalya scheme will inculcate the habit of savings among young subscribers and large wealth can be accumulated through power of compounding. The Union Finance Minister emphasised that the scheme will allow dignified life to people in their old age.

Commending the success of Atal Pension Yojana, the Union Finance Minister said, “Since its inception in 2015, 6.90 crore people have subscribed to the Atal Pension Yojana and the corpus worth Rs 35,149 crore has been accumulated.”

Underling the competitive returns in NPS scheme since its inception, Smt. Sitharaman said, "For the Government Sector, NPS, on average, has given returns of 9.5% Compound Annual Growth Rate (CAGR) since its inception.”

In his address on the occasion, Union Minister of State for Finance Shri Pankaj Chaudhary said that NPS Vatsalya scheme is a significant step by the Government towards inclusive economic development and all the institutions involved in scheme implementation were urged to ensure maximum coverage and saturation of the scheme.

In his address on the occasion, Shri Nagaraju Maddirala, Secretary, DFS, underscored the imperative of collaborative approach by stakeholders including banks for effective implementation and outreach of the NPS Scheme.

Shri Maddirala said that efforts are being made to include more workers from the informal sector into the pension fold. Comprehensive financial education and literacy campaigns by DFS targeted towards pensions are implemented to raise awareness about the importance of retirement planning and the benefits of participating in pension schemes.

Shri Maddirala said, “The pension sector in India is at a crucial juncture. Recent reforms have expanded the scope of pension coverage, aiming to create a more inclusive system by offering more products through higher number of channels. We endeavour to build a more inclusive and sustainable pension system by keep reforming and be receptive of subscriber feedback and concerns.”

In his address at the launch, Dr. Deepak Mohanty, Chairperson, PFRDA, said, “It is the Government’s forward-thinking approach, under the overarching objective of provision of social security for all, that NPS Vatsalya is launched today. It enables us to tap into the power of compound interest, potentially leading to substantial wealth accumulation over time securing the financial future of our younger generation.”

In the matter of pension an early start is a head start: small amounts squirreled away could yield substantial corpus by harnessing the power of compounding. People often have various financial priorities and may not always consider retirement planning until later in life which often results in inadequate old age income. Thus, there was a felt need for a pension scheme inculcating a culture of early saving and investment.

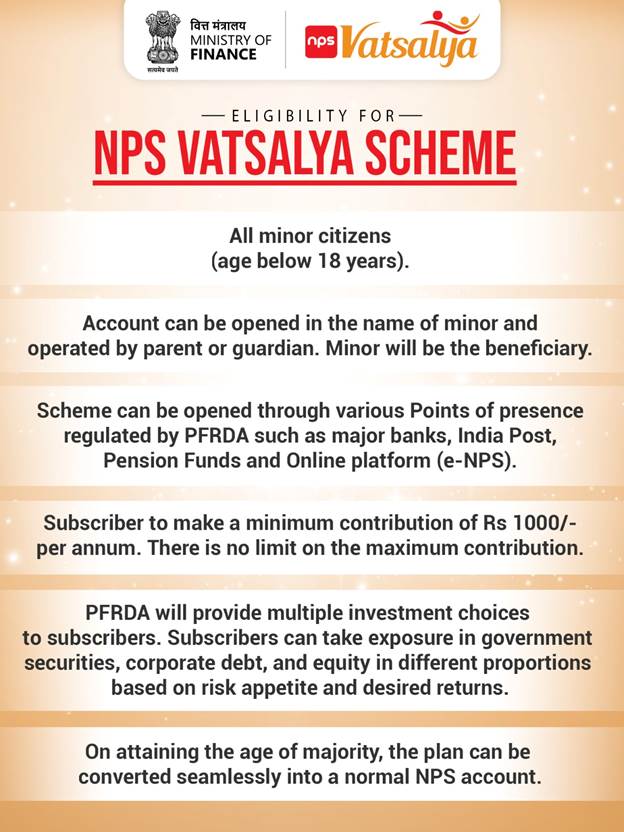

Eligibility for NPS Vatsalya as follows:

- All minor citizens (age below 18 years).

- Account can be opened in the name of minor and operated by parent or guardian. Minor will be the beneficiary.

- Scheme can be opened through various Points of presence regulated by PFRDA such as major banks, India Post, Pension Funds and Online platform (e-NPS).

- Subscriber to make a minimum contribution of Rs 1000/- per annum. There is no limit on the maximum contribution.

- PFRDA will provide multiple investment choices to subscribers. Subscribers can take exposure in government securities, corporate debt, and equity in different proportions based on risk appetite and desired returns.

- On attaining the age of majority, the plan can be converted seamlessly into a normal NPS account.

****